Tax season for small businesses - what you need to know

Bromwich+Smith team

27 Mar, 2025

Tax time is always challenging, and if you’re adding a business into the mix, it’s easy to feel overwhelmed. Let’s break things down into more manageable steps so you can feel confident about prepping for your small business taxes this year.

Be Organized

One of the biggest gifts you can give your small business during tax season is to be well organized and prepared. When things seem too complicated or difficult to understand, we tend to procrastinate or even ignore the situation. We all know from experience this usually makes things worse. So, why not start getting organized? Here’s what you’ll need:

- Previous tax return

- Revenue, income, dividends

- Expenses

- Receipts

- GST, Payroll

- Speak to your Bookkeeper, Accountant or check out the CRA site for more details

- Don’t have a bookkeeper or accountant? Ask us about our reputable partners. You can even designate a professional as your Authorized Representative to act on your behalf and deal directly with CRA

Start planning for next year’s tax returns now. It may seem early, but setting up an organizational system before the new year begins will make filing your taxes much easier when tax season arrives. Here are some tips to help you get started:

- Get a checklist of what you should keep

- Explore ways to reduce your business taxes next year

- Look at tax shelters for your business and create an easy to manage system to stay organized all year.

With a great system, tax filing time can be as easy as handing over a binder or file folders neatly organized and labelled for your tax professional. This will reduce stress and can set you up to keep more money in your business rather than with the CRA.

Be Prepared for the Worst Case

Unfortunately, there is still some uncertainty around claw backs and other repercussions from the various small business grants and government stimuli handed out during the pandemic. Businesses are often audited and taxed differently than individuals and there can be a balance owing to the CRA. Some people may owe tax when they file a return, depending on their personal circumstances, the type of benefits received, other sources of income, deductions and credits according to the CRA. It’s wise to be prepared and keep some cash aside to cover any balances.

What if you don’t have the cash available or not enough to cover your CRA bill?

Check to see if you qualify for any tax credits. Depending on your province and your circumstances you may qualify which can help to minimize what you owe the CRA. Consult your tax professional for details.

If there are no credits or not enough and you still have a balance owing to the CRA, consider payment arrangements or contacting the CRA directly for more options. If this is still stretching you too thin or feels too overwhelming, then the best alternative is to speak with a Licensed Insolvency Trustee. Now, this does not necessarily mean you have to declare bankruptcy. A great alternative to bankruptcy is a consumer proposal.

The advantages of a consumer proposal for small business owners are:

- You keep your assets

- You can continue to be the director of your company or become one in the future.

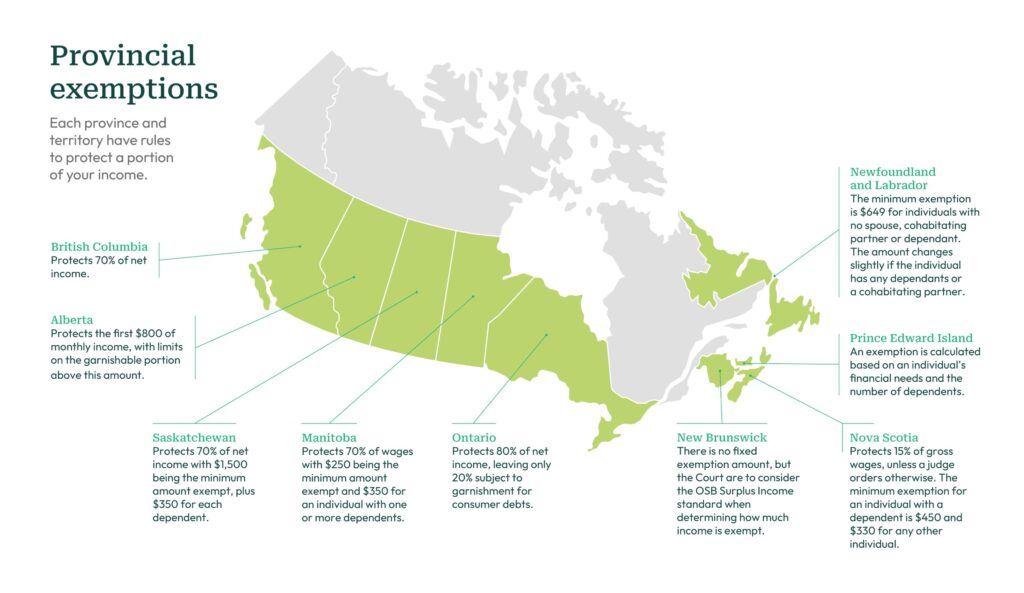

- There are assets that cannot be taken away from you depending on the province you live in.

- Your credit report is less affected than if you were to file for bankruptcy.

- You can rebuild credit during the proposal.

- One monthly payment with no interest.

- You can pay it off early if you choose or when your business grows again.

- It’s one of two ways to rid yourself of the crushing burden of CRA debt.

Filing your tax return is inevitable, but facing overwhelming tax debt doesn’t have to be. Know your rights and have the courage to seek help – it’s one of the bravest things you can do. You’re not alone, nor do you need to face this alone. Just like you consult professionals to help with supply chain, marketing, and other aspects of your business, you want to surround yourself with financial experts to help you keep more money in your business. A good, qualified, experienced business accountant is vital to ensure your business is CRA compliant, taking advantage of all business tax shelters, off sets, that you have the right information and file your business taxes on time and thoroughly.