What to know about wage garnishment

Bromwich+Smith team

21 Jan, 2025

Understanding debt can be overwhelming. It’s not just about the numbers – it impacts your emotional well-being, self-worth and mindset.

In Canada, if you owe money and stop making payments, creditors have the right to take legal action against you. Once they obtain a court judgment, they can garnish a portion of your paycheque without your immediate consent. This can be an isolating experience, one that includes feelings of defeat and anxiety. However, it’s important to remember that you’re not alone. Every year thousands of Canadians experience similar financial challenges. It’s also not permanent and there are steps you can take to stop wage garnishment or reduce it. With the right information, you can take back control and make informed decisions.

Why might your wages be garnished?

There are several reasons why garnishment might occur and understanding these can help you take preventive measures. Here are some common scenarios when it might happen:

- Unpaid debt

- This is the most common reason for wage garnishment

- Child or spousal support

- When you fail to make required child support payments, courts may order wage garnishment to ensure the financial support of the child

- Garnishment for support payments can exceed 50% and cannot be paused with a bankruptcy filing

- Unpaid taxes

- If you owe back taxes, the CRA may use wage garnishments to collect these from you. The CRA may garnish a higher percentage of your income, depending on the debt owed

- Alimony

- Spousal support or alimony may also be subject to wage garnishment if the paying spouse fails to meet their financial obligations

- Defaulted student loans

- In the case of federal student loans, the government has the right to garnish wages if you default on your loan payments

How much of your wages can be garnished?

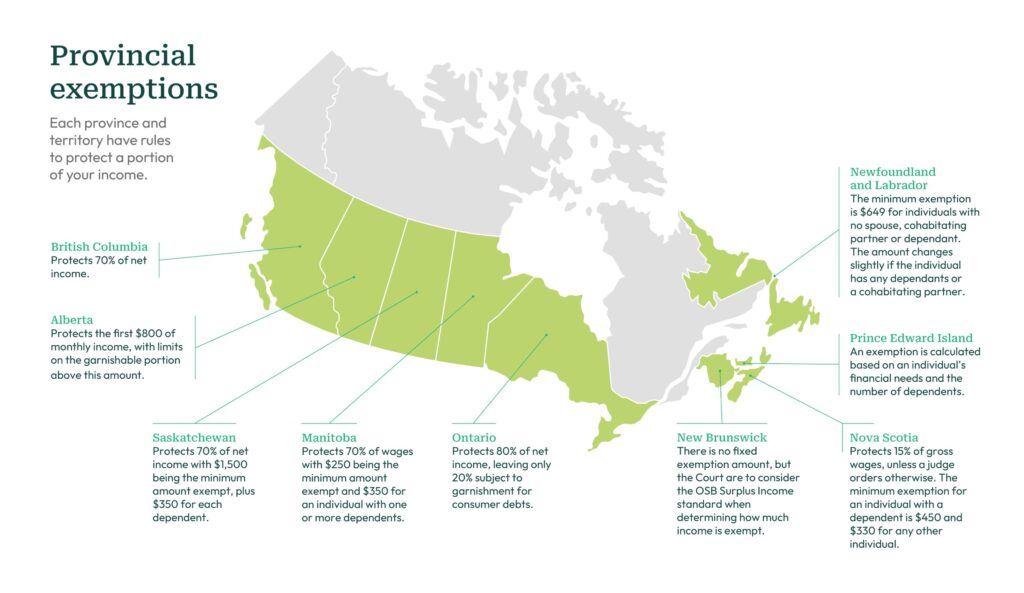

The amount that can be garnished depends on the specific debt, and where in Canada you live as each province and territory has its own exemptions.

Provincial exemptions

Each province and territory have rules to protect a portion of your income.

- Alberta: Protects the first $800 of monthly income, with limits on the garnishable portion above this amount

- Ontario: Protects 80% of net income, leaving only 20% subject to garnishment for consumer debts

- British Columbia: Protects 70% of net income

- Saskatchewan: Protects 70% of net income with $1,500 being the minimum amount exempt, plus $350 for each dependent

- Manitoba: Protects 70% of wages with $250 being the minimum amount exempt and $350 for an individual with one or more dependents. · New Brunswick: There is no fixed exemption amount, but the Court are to consider the OSB Surplus Income standard when determining how much income is exempt

- Newfoundland and Labrador: The minimum exemption is $649 for individuals with no spouse, cohabitating partner or dependant. The amount changes slightly if the individual has any dependants or a cohabitating partner

- Prince Edward Island: An exemption is calculated based on an individual’s financial needs and the number of dependents

- Nova Scotia: Protects 15% of gross wages, unless a judge orders otherwise. The minimum exemption for an individual with a dependent is $450 and $330 for any other individual

Who has rights during wage garnishment?

In Canada, if you owe money and stop making payments, creditors have the right to take legal action against you. Once they obtain a court judgment, they can garnish a portion of your paycheque, directing it straight to them without your immediate consent. Before resorting to garnishment, creditors typically try to collect the debt owed through calls, overdue notices or collection agencies. If these fail, they may seek a court-approved garnishment order. It is important to note, that not all your creditors need this step in order to garnish your paycheques. The CRA, credit unions, and banks can garnish without a court order. Banks will refer to this as the right to offset.

Canada’s laws provide some protection to ensure garnishment doesn’t leave you without the ability to support you or your family. It’s important to know that you do have rights in this situation, including:

- Notification

- You must be notified about the garnishment, the debt amount and your options for disputing it before your employer is informed

- Income protection

- A portion of your wages are protected from garnishment to cover living expenses. This will vary depending on the province or territory you live in

- Challenging the garnishment

- You can dispute the garnishment in court if you believe it’s excessive or unfair

- Job protection

- Your employer is not allowed to end your employment contract due to wage garnishment

How to stop or prevent wage garnishment

If you’re currently facing wage garnishment or are worried that your creditors may start, there are practical steps you can take to stop it.

1. Negotiate with creditors

It’s easier to stop wage garnishment before it takes place. Talk to your creditors early and attempt settlement. Having the conversation may seem daunting, but it’s worth being honest and coming up with a repayment plan. Making arrangements directly with your creditors and sticking to your payment plan will help build trust

2. File a motion to reduce garnishment

In some cases, you can request a court to reduce the garnishment amount if it leaves you unable to meet basic needs

3. Seek professional advice

Licensed Insolvency Trustees (LITs) can help you explore formal options like a consumer proposal or bankruptcy, both of which stop wage garnishment.

- Consumer proposal: This legally binding agreement typically allows you to settle your debts for less than you owe and repay them through manageable monthly payments over a set term

- Bankruptcy: This eliminates most unsecured debts and provides an automatic stay of proceedings, meaning all wage garnishment and creditor communications must stop

Why acting early is crucial

Wage garnishment reduces the money you see directly, making it harder to keep up with financial obligations. Money that has been garnished could have been used to repay financial obligations and improve your credit score sooner. Ultimately, delaying action when facing wage garnishment prevents you from rebuilding your financial health.

Although, wage garnishment can feel overwhelming, it’s not permanent. Understanding your rights, exploring your options, and seeking professional help can stop wage garnishment and put you back in control of your financial story.