Five Ways to Manage Financial Stress

rebuild your worth, book a free consultation todayBook Now

Consistent with previous years, money continues to be the number one cause of stress for Canadians, by a large margin. Money (38 per cent) outranks personal health (25 per cent), work (21 per cent) and relationships (16 per cent) as the top source of stress in Canadians’ lives.

And now with a global pandemic, many Canadians face financial uncertainty. "This pandemic has added an extra layer of financial uncertainty for Canadians," said Kelley Keehn, author, personal finance educator and Consumer Advocate for FP Canada. "As millions grapple with the repercussions of job loss, reduced hours and market volatility, it’s more important than ever to seek out expert assistance.”

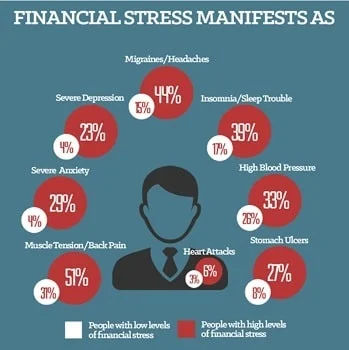

It's easy to see why it’s more important now than ever before to equip ourselves with the right tools to manage and relieve financial stress! Let’s take a closer look at how financial stress manifests itself. It may surprise you that financial stress can and does, in fact manifest in physical and mental illness. You can see from the image above that headaches, ulcers, anxiety, and depression are some of the ways in which financial stress can manifest.

How do you manage financial stress?

Now that we understand how financial stress can manifest, let’s explore our top five tips for managing financial stress.

Tip #1: Track Expenses with a Budget. A budget is a simple way to track your income and expenses. Did you know that 53 per cent of Canadians do not have a budget and are not tracking their income and expenses? Start by creating a budget and track your income and expenses for at least three months to understand where your money is going. You may find some opportunities where you can save money and minimize expenses. You can use Bromwich+Smith budget-planner to get started. We often feel frozen and unable to act when we are stressed out. By taking small, actionable steps, you will create habits to support you in managing stress and improving your finances.

Click to Book A Free Consultation

Tip #2: Practice Gratitude + Affirmations. Practice gratitude daily by staying focused on what is positive in your life; this will help you alleviate stress and stay motivated. Another thing that helps one to minimize stress and anxiety, especially when it comes to finances is to create affirmations that you believe to be true about yourself. Then, get in the habit of saying these personalized affirmations out loud to yourself everyday. By remaining focused on what is going well, you will be more likely to maintain a positive mindset, and this will contribute to you staying motivated to accomplish your financial goals.

Tip #3: Create an Emergency Fund. Some of our financial stress can be related to worrying about the future and feeling unprepared. There are as many opinions about how much you need for an emergency fund as there are financial professionals, but the key is to have your own emergency fund in place. It’s not about the size of the emergency fund, but the peace of mind it brings. Start by increasing your savings with what you can each month until you feel comfortable with the amount you have saved. Every little bit of money saved, will amount to much over time.

Tip #4: Treat yourself with grace + kindness. At Bromwich and Smith, one of our core values is treating everyone with grace and respect. Just as charity begins at home, grace begins within. Remember to go easy on yourself and know that you are not alone. If you are struggling with your finances, there is help available. Did you know in Canada, we have a legal exit strategy for honest Canadians who find themselves overwhelmed by the burden of debt?

Licensed Insolvency Trustee firms are federally legislated, licensed and regulated, and are the only ones who can administer legal debt forgiveness through consumer proposals and bankruptcies. Take solace in this fact. It is your legal right to reach out to a federally legislated Licensed Insolvency Trustee who can provide you with effective solutions to manage your debt.

Tip #5: Seek Help. We all need a little help from time to time and knowing when to reach out for help takes courage and strength. Be mindful of where you turn for that help. When it comes to your physical health, we seek help from a professional doctor that holds a medical license. When it comes to your financial health, we should seek help from a professional that holds an insolvency license, such as Bromwich+Smith, a Licensed Insolvency Trustee.

Click to Book A Free Consultation

Too much stress can have a negative impact on your mental health and even more when you are dealing with financial stress. Don’t be afraid to seek help. It is important to know that there are solutions to support you with managing your finances and to get out of debt.

No matter how difficult or complicated your financial situation may seem, there are options available to help you rebuild and thrive. Our Debt Relief Specialists are available by phone at 1.855.884.9243, or you can request a call back via our contact us page. There is no need to travel to a local office. Licensed Insolvency Trustee, Bromwich+Smith, is now offering video appointments, with all services available from the comfort of your home.

By Taz Rajan Community Engagement Partner at Bromwich+Smith

Taz has been in the finance industry for nearly two decades and has always been passionate about education and empowerment. Having declared bankruptcy herself, she intimately understands the shame, stigma surrounding matters of debt as well as the joy and relief that comes from restructuring. Taz actively works to normalize the conversation of debt through blogs, media interviews, webinars, lunch & learns and through building relationships.

Click to Book A Free Consultation